In the face of Canada's blazing real estate market, lenders are foreseeing historically high losses. Statistics Canada data indicates expected credit losses (ECL) increased in Q3 of 2020. ECL's are currently at a record high says StatCan, though make up for only a small portion of total mortgage debt.

Expected Credit Losses are the amount companies anticipate losing. The figure derives from risk assessments used to determine how much money is needed to be retained to cover losses of bad debt. A company's solvency can be jeopardized if too little funds are set aside for unexpected risk events. Setting aside too much cash - funds that could have been invested are stuck dragging on earnings. This has forced banks and lenders to calculate risk as precisely as possible.

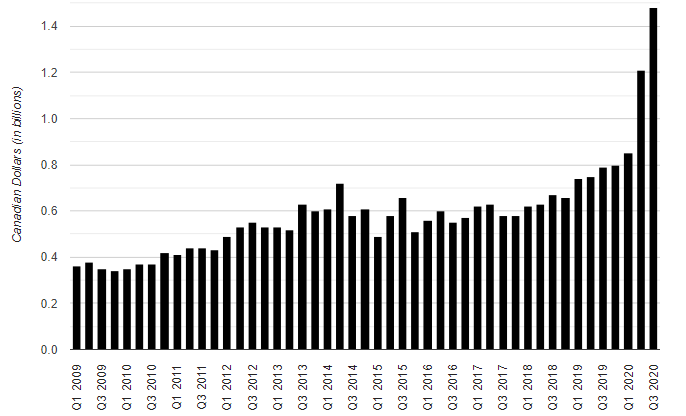

ECL's related to mortgages jumped as per recent data released by StatCan, reaching historic levels. ECL's rose to $1.482 billion in Q3 2020, an increase of almost 23 percent from the previous quarter - and a whopping 86 percent increase compared to last year.

The estimated quarterly dollar amount of expected credit losses related to mortgage debt, in billions of dollars.

Source: StatCan

Source: StatCan

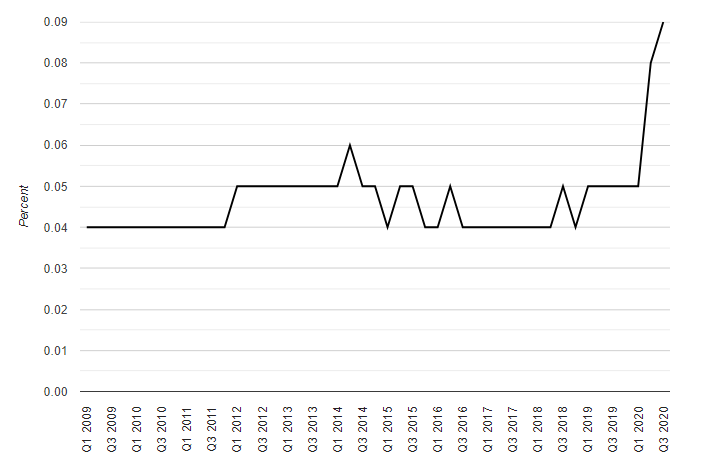

Through the lens of a banking or government perspective, this is a rather modest figure. Suppose the amount was double, banks could still easily take in 0.09% of mortgage debt. We're looking at a considerable jump in losses, though rapidly increasing mortgage debt makes the problem seem smaller. Losses of $1.482 billion will lead to more defaults, but Q3 did see $40.79 billion in new purchase mortgages - that surge of cash outpaces the the potential losses by a sizeable margin. This will make the lives of lenders a little easier.

The estimated quarterly ratio of expected credit losses related to mortgages, as a percent of total outstanding mortgage credit.

Source: StatCan

Source: StatCan