Housing pricing worldwide is rising at the fastest rate we've seen since the beginning of the financial crisis in 2006. This comes on the heels of a housing boom present across global markets during an unforeseen pandemic.

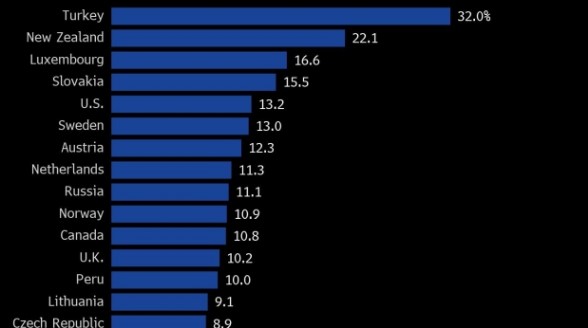

Average home pricing rose 7.3 per cent between March 2020 and March of this year, the most feverish pace since 2006's fourth and final quarter. Knight Frank a leading property consultancy released their most recent Global House Price Index last week. Turkey led the charge, showing 32 per cent growth, New Zealand was second with 22 percent. The United States placed fifth with 13.2 per cent growth, its most significant jump since late 2005.

Serious stimulus both fiscal and monetary, helped shore up economies during the pandemic - but it also fueled a fire of a housing frenzy. Many countries have already responded with efforts to cool their respective markets.

New Zealand has eliminated tax incentives privy to investors and speculators and its government anticipates home price inflation will fall to just under a percent by mid next year. China has started limiting bank lending to developers to in hopes of slowing the housing craze.

“With governments taking action and fiscal stimulus measures set to end later this year in a number of markets, buyer sentiment is likely to be less exuberant,” explained Knight Frank in the report. “Plus, the threat of new variants and stop-start vaccine rollouts have the potential to exert further downward pressure on price growth.”

Singapore registered the most significant gain in Asia with a 6.1 per cent increase. South Korea was not far behind at 5.8 per cent, while Japan saw a 5.7 per cent growth. Hong Kong, the world's most expensive housing market, saw a 2.1 per cent increase. The index documents and registers benchmark pricing for 56 countries worldwide.