As the state of home affordability worsens across the country, data recently released by CIBC shows parents are gifting increasingly more money to their kids to help with first home purchasing.

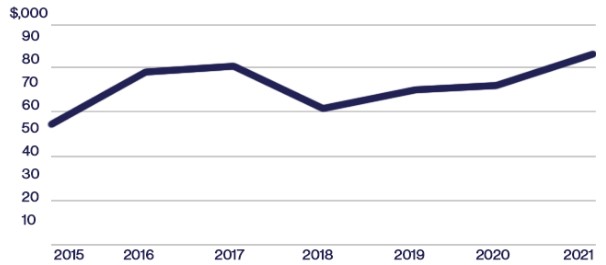

Benjamin Tal, deputy chief economist, figures that nearly 30 per cent of first-time home buyers turn to their parents and have received on average, a record of $82,000, a pale comparison to $52,000 in 2015. Tal estimates that number to be much higher in hotter markets - with an average gift of $80,000 in Vancouver and $130,000 in Toronto.

Average Down Payment Gift

Source: CIBC

“No less than two-thirds of first-time buyers that received a gift indicated that the gift was the primary source of their down payment,” Tal wrote in a report released earlier this week.

The Canadian Real Estate Association revealed that national home sales increased by a meager 0.9 per cent in September from the preceding month, as inventory remained limited. The MLS Home Price Index revealed that the benchmark home price reached $750,400 last month.

“Overall we estimate that over the past year, gifting amounted to just over $10 billion, accounting for 10 per cent of total down payments in the market as a whole during that period,” added Tal.

Though parental assistance with down payments have helped shorten the wealth disparity between first-time home buyers and their parents' generation, Tal explains it concurrently creates a wealth disparity between those lucky enough to receive gifts as aid and those who aren't as fortunate.

With respect to how parents are able to gift such amounts, Tal explained there's no indication to suggest that parents are incurring debt in doing so.

“Therefore, it seems that a large portion of the gifting comes from parents’ savings, which of course grew notably during the pandemic—allowing for the increases in the size of the average gift,” concluded Tal.