The Canadian real estate market is undoubtedly in a precarious state - and households will now be devoid of guidance from the country's housing agency. The Canadian Mortgage and Housing Corporation has put a pause on its Housing Market Assessment (HMA) Report. The report provided Canadians with observations on the country's housing market imbalances and discrepancies. This interlude comes after the last report which signalled that the housing market was "highly vulnerable" , along with the central bank's rollout of interest rate increases.

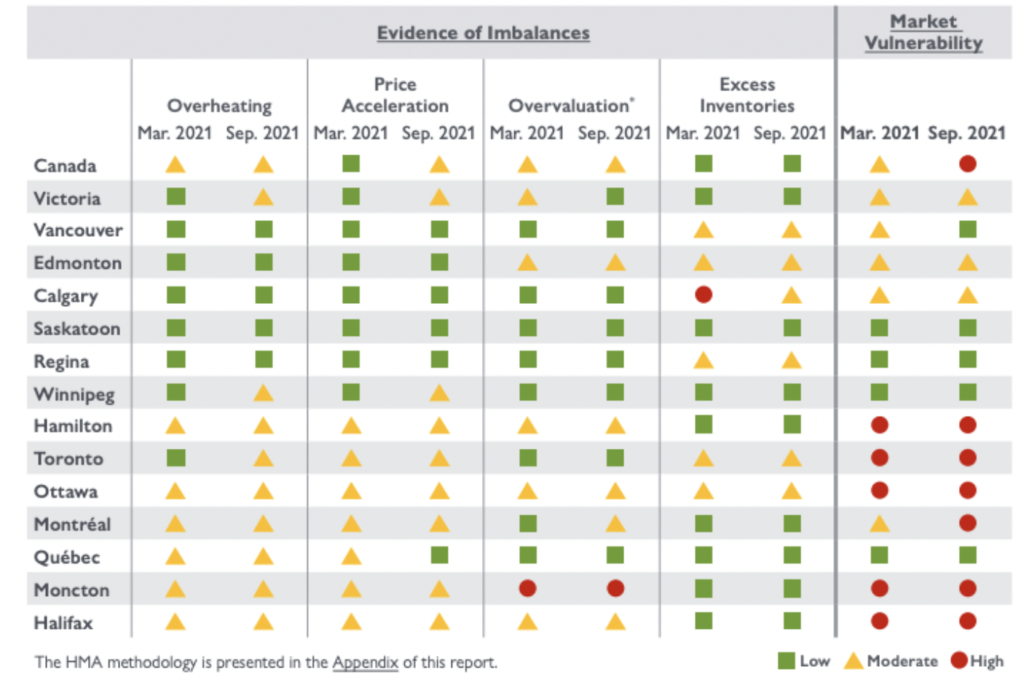

The HMA was essentially the national housing agency's risk adviser in regards to the housing market. Overvaluation, overbuilding and accelerated price of growth were some of the report's indicators. These components would then decipher the rate of imbalance, on a three point rating system. In the HMA, The housing market was rated either low, moderate or high for level of vulnerability.

The last report, released in September 2021, indicated that the national housing market was at risk. Since then, the housing market has experienced substantial gains and price growth is at a staggering 10 points higher.

Source: CMHC

Source: CMHC

Many pundits wondered when the next report would be released, but in early March, the CMHC silently posted a notice of cancellation of subsequent reports or updates. “We’re refocusing our resources to get a better understanding of housing supply and affordability issues across Canada. We’ll continue to closely monitor the health of Canadian housing markets and update Canadians through existing publications.”

The Canadian Mortgage and Housing Corporation has been under scrutiny for some time now, especially at the beginning of COVID-19, where it warned home prices would fall 20%, leading a to a full-blown panic among buyers and policymakers. Both the Bank of Canada and Federal government intervened, thus sending prices in the other direction.

This was under the much-maligned Evan Siddall's leadership, though. Romy Bowers, who was named CMHC president last August, has openly discussed the need to increase market share. But without the HMA, a useful tool for consumers, Canadians are now responsible with being more vigilant in their monitoring of the country's housing situation.