According to the US Federal Reserve exuberance index, Canada is one of only two G7 countries classified as an exuberant market, with Germany being the other. The two countries also house the longest running real estate bubbles of any advanced economy.

The Fed observes global housing markets for exuberance, in hopes of identifying bubbles. In regards to the index, exuberance means aggressive price increase that surpasses market fundamentals. The Federal Reserve tracks this in hopes of helping prevent crashes like the one of 2006 from occurring again.

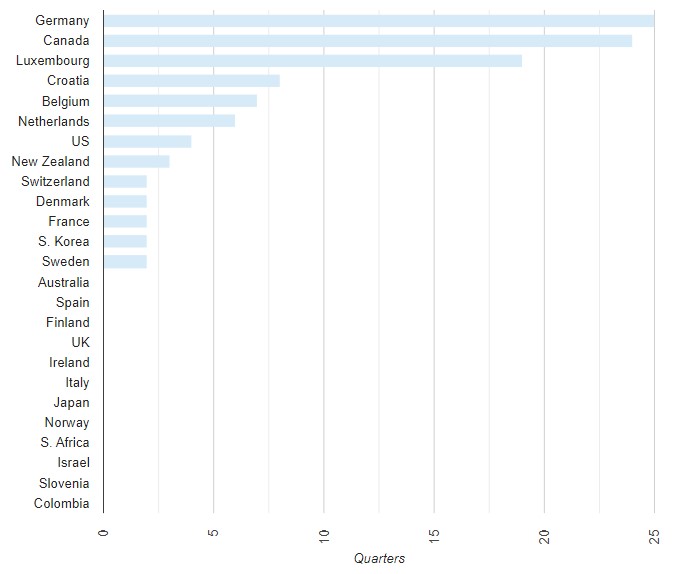

When exuberance becomes persistent and without correction, is when there is cause for concern. Fed analysts say five consecutive quarters of exuberance is when a market is labelled exuberant or considered to be a bubble - this is where corrections are much needed.

Canada was first labeled as exuberant 24 financial quarters ago, without a correction. Of those 24 quarters, two of them showed low signs of exuberance, but not substantial enough for prices to correct or to establish a new trend. As mentioned above, Canada has the second longest running bubble period in the entire G7, Germany is first.

Germany has recorded 25 consecutive exuberant financial quarters, with no reprieve. The Fed estimates that since 2005, Canada's housing prices increased by 173%. Over the same period of time, Germany is estimated to have experienced 74% of price growth.

Many believe that buyers are exuberant across the world, but that simply is not true as per the Federal Reserve. They examine 25 advanced economies and only six of them fall under the exuberant category. Other than the two previously mentioned countries, there were Luxembourg, Croatia, Belgium, and the Netherlands