Canada's housing market is hinting at a downtrend that is likely to lessen the sector's impact on the country's economy, but as per a major bank economist, not significant enough to be of major concern.

“Now that Canadians are leaving their homes more often, demand for housing is cooling off after a period of historic strength,” Canadian Imperial Bank of Commerce economist Royce Mendes explained last Friday in a report. “As a result, we do expect this component of GDP to come back down to earth.”

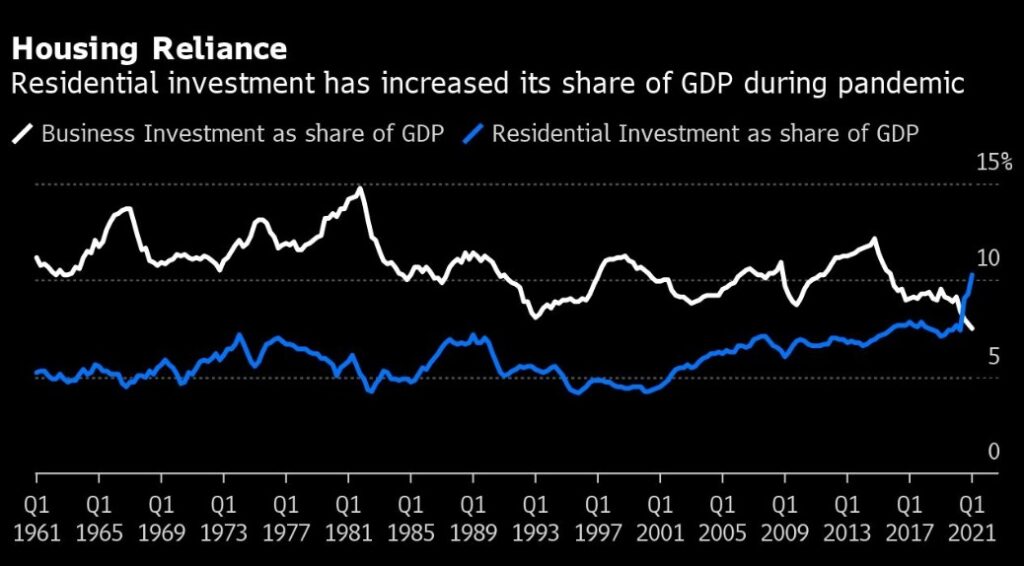

A restoration of balance to the housing market may not shock the economy as severely as most would think - house prices do not factor into residential investment and employment tied to the industry are likely to remain unaffected, explained Mendes. Business investment -- a major component of gross domestic product that fell off during the pandemic -- is likely to pick up soon as vaccine percentages continue to rise and confidence continues to improve, he added.

Source: Statistics Canada, CIBC

Source: Statistics Canada, CIBC

COVID-19 has rearranged economic activity in the country, as residential investment made up for a larger share of output than business investment for the first time in nearly sixty years. Residential investment made up for roughly 10 per cent of full output at the end of this year's first quarter, outpacing business investment which reached 7.5 per cent.

Lockdowns drove many Canadians out of city condo and apartments, and into homes with more space. A combination of low interest rates and an increasing demand for larger living areas pushed prices and sales numbers upward. Some economists have cautioned about the potential financial and economic ramifications that could follow a market downturn. With a cooling housing market and price growth slowing down, Canadians will have more money to be put towards necessities unrelated to real estate, said Mendes.

“The reopening that is underway also seems to be coinciding with a slowdown in other components of residential investment,” stated Mendes. “But, by that same token, companies not doing business in the housing market might also feel more confident making investments rather than stockpiling cash, given that vaccinations have reduced the likelihood of another round of harsh shutdowns.”