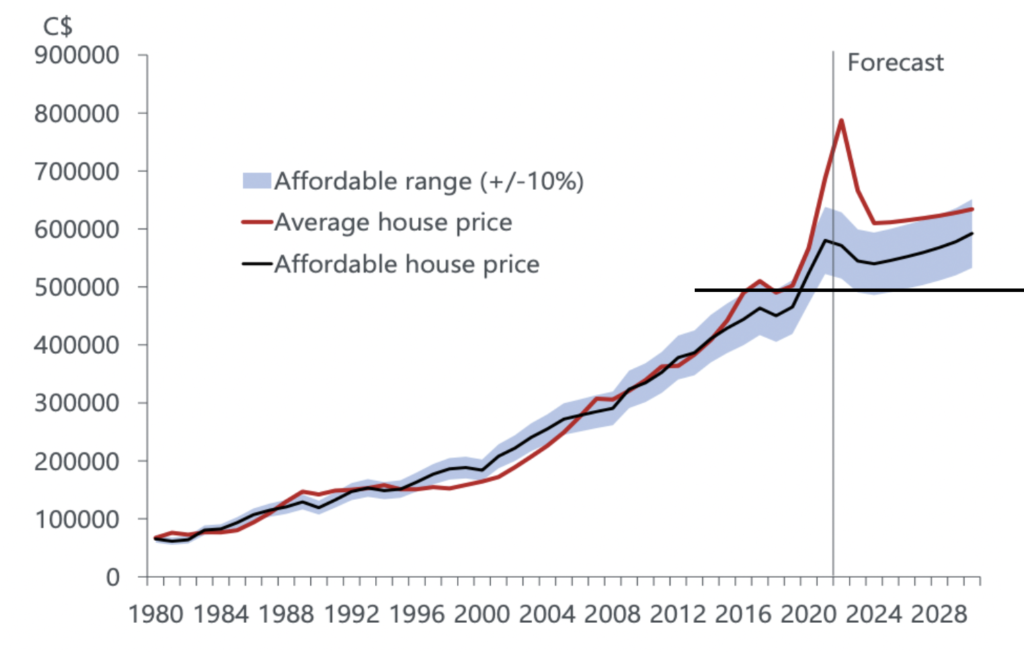

According to one of the world's most respected voices on economic forecasts, Canadian real estate prices are in for quite the dip. Oxford Economics' most recent forecast shows home prices decreasing by 24% by the middle of 2024. Increasing interest rates coupled with anti-speculation measures are expected to trigger a price drop this year. If prices aren't corrected, and rise higher, Oxford is forecasting a 40% drop followed by a financial crisis.

Source: Oxford Economics

Source: Oxford Economics

Starting this fall, the firm is calling for a 24% decline that should tail off by mid 2024. The firm expects the post-correction prices to still be 15% higher than pre-pandemic levels. Oxford Economics does not expect prices to bounce back after that. From 2025 to 2030, they're forecasting supply to outpace demand and annual growth to sit under 1% for five years. This should make possible for incomes to catch up and for affordability to become a reality by mid-2028.

Two years ago, the firm didn't see such a serious price decline as possible. But then 2020 happened, pushing prices upward to new extremes. If prices persist with the "unsustainable' climb, the correction is likely to turn into a crash, or a 40% price drop as noted in the forecast.

Oxford Economics uses standard price data, and sees inflation having a big role in affordability. Investors will want to keep an eye on this because CREA’s benchmark price is adjusted to inflation. If the Bank of Canada can oversee a 2-point inflation target from 2024 to 2030 - by year 2030, the price of a home will be 5% higher than the inflation adjusted value seen in 2020.

The firm believes a price correction “may cause some near-term pain,” but is required for a healthy economy going forward. Recent home buyers and investors would be the most-affected. If things were to remain as they are, we're likely to see long-term damage to Canada's economy.