According to new data released by the Canada Mortgage and Housing Corporation (CMHC), mortgage delinquencies remained mostly flat over the course of Q3. The age breakdown did reveal some sobering realities, though: delinquencies for seniors are ascending aggressively. Stabilizing the statistic was a lower rate in millennial mortgage delinquencies, aiding the illusion of a wash.

Canadian Mortgage delinquencies have not moved much on the large-scale compared to the previous quarter. The rate of delinquencies was 0.30% for Q3, flush with both the previous quarter and last year. The rate is essentially stable, despite the pandemic. However, focusing on the respective ages of these numbers will illustrate a different picture.

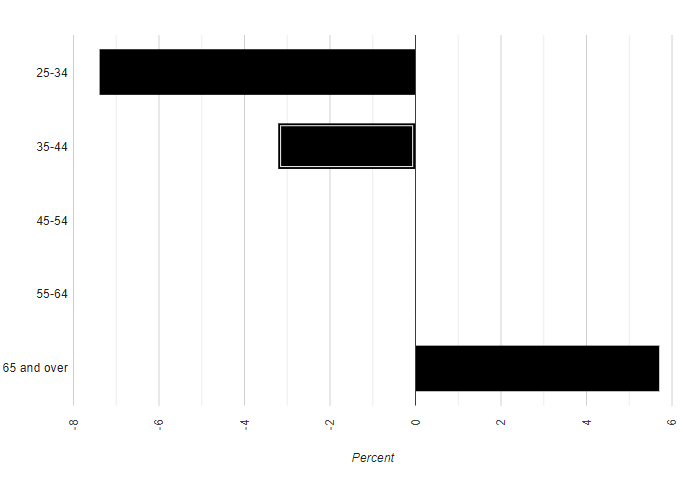

The mortgage delinquency rate for Canadian seniors is on the rise and at its highest level in years. The rate rose to 0.37% in Q3, increasing 2.78% since the last quarter. That's a fairly sizeable rise of 5.71% compared to Q3 2019. Delinquencies for senior mortgagees have not been this high since 2017. This rate is substantially greater than the national rate.

Canadian Mortgage Delinquencies by Age

12 month change in mortgage delinquency rate Q3 2020

Canadian mortgagees between the ages 45 and 64 stayed relatively quiet in regards to delinquencies. The rate of delinquencies for the 55 to 64 age group was 0.28% in Q3, flat from the previous quarter and year. Those between 45 and 54 came to a slightly higher rate of 0.30%, unchanged for the most part, over the same periods as well. The rate for the aforementioned age brackets are off multi-year lows, but are essentially stable. This demographic is just below the average.

Middle aged and younger households help balance out the rising level in seniors. Mortgagees between the ages of 35 and 44 had a delinquency rate of 0.30% in Q3, consistent with the previous quarter. This rate is surprisingly 3.23% lower than last year's third quarter. This group is in line with the national average.

Millennial mortgage holders, aged 25 to 34 experienced an even greater decline for in delinquencies. The rate dropped to 0.25% in Q3, unchanging from Q2. The rate is at a staggering 7.14% lower compared to Q3 2019 and well below the current national average.