Canadian home sales saw their largest decline since last June as increased interest rates have started to cool the country's sizzling housing market.

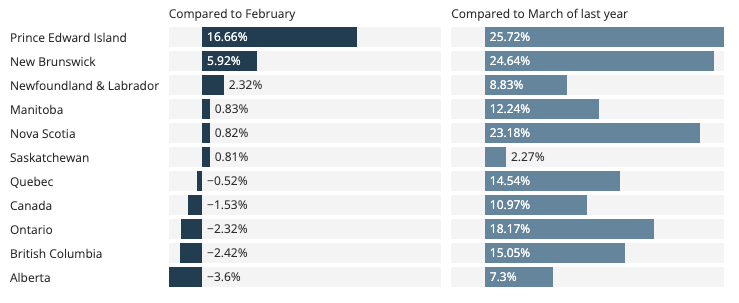

According to a new report from the Canadian Real Estate Association, national home sales dropped 5.4 per cent in March, compared to February. New listings dropped at nearly the same rate. Regardless of the decreased market activity, benchmark prices still inched 1 per cent upward, and is now up 27 per cent from a year ago.

Home sales have dropped 16 per cent from a year ago, where transactions hit an all-time high in March. The average home price came in at $796,000, down from the record-high seen in February.

"While the market remains historically very active, March definitely saw a slowdown compared to February in terms of both activity and price growth," CREA chair Jill Oudil explained. "One month does not make a trend, so we'll have to wait and see if this is the beginning of the long-awaited cooling off of this market."

Rising borrowing costs and policy decisions intending to curb demand are creating more obstacles for prospective buyers, who are already facing record prices. The Bank of Canada has raised its policy rate by 0.75 points since March, and many are expecting increases totalling 2 full percentage point over the next year.

Robert Kavcic, economist at Bank of Montreal, believes markets are unlikely to experience the full impact of increased borrowing costs until the second half of this year. He says it's too early to tell if March indicates an anomaly or the start an introduction to a downward trend, but he speculates the latter.

"Keep in mind that last March was the absolute summit of the pandemic demand mountain, so the reported year-over-year drop is somewhat exaggerated," he said in a note to clients Tuesday. "There are signs that the appetite is pulling back amid higher mortgage rates, and the decline in March might be the first in a longer series of softening trends."